Confused about whether to classify a worker as an independent contractor (1099) or an employee (W-2)? You’re not alone. It’s a crucial decision that can significantly impact your business and the worker, affecting your tax obligations, the worker’s benefits, and your legal liability.

In this post, we’ll break down the differences between 1099 and W-2 workers, explore the true cost of employment, and provide a roadmap to help you navigate this critical decision.

Independent Contractor (1099)

An independent contractor is essentially a self-employed individual or entity that you contract with to provide specific services. They’re responsible for paying their own taxes and aren’t entitled to employee benefits.

Employee (W-2)

Unlike an independent contractor, a W-2 employee is hired and paid by your business, with taxes withheld from their paycheck. They may also be eligible for benefits like health insurance and retirement plans.

Key Differences

| Factor | 1099 | W-2 |

|---|---|---|

| Tax Withholding | No | Yes |

| Benefits | Not Eligible | May Be Eligible |

| Payment Frequency | Per Contract | Regular (e.g., Bi-Weekly) |

| Work Schedule | Flexible | Set by Employer |

| Control Over Work | High | Low |

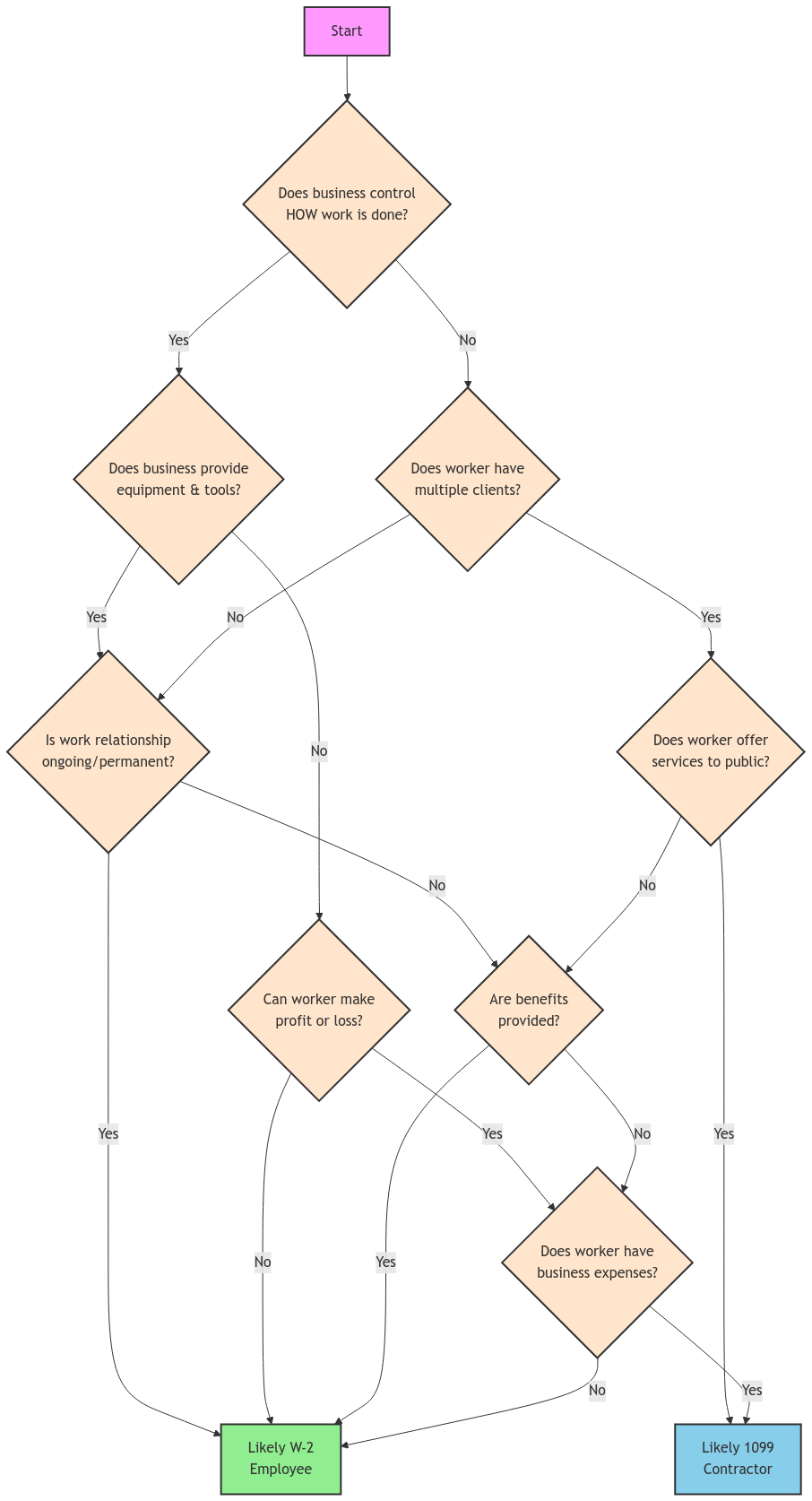

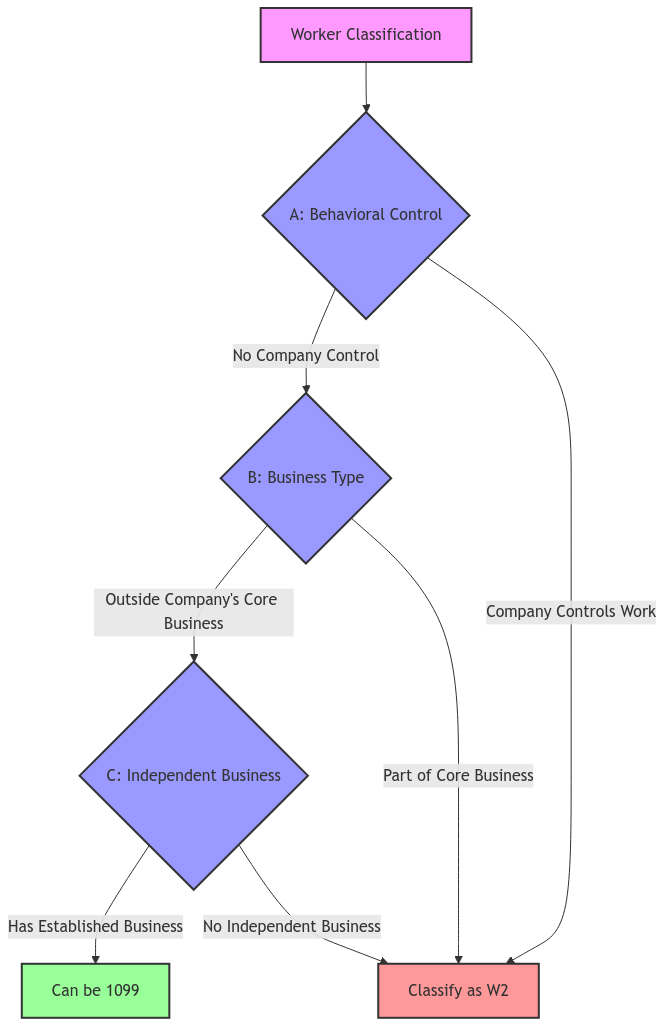

Determining Worker Classification

The IRS uses several factors to determine worker classification, including:

- Behavioral Control: Does the business control what the worker does and how they do it?

- Financial Control: Does the business control the financial aspects of the worker’s job (e.g., payment method, expense reimbursement, tools)?

- Relationship: Are there written contracts, benefits, and is the work a key aspect of the business?

No single factor is determinative; the IRS considers the entire relationship.

1099 Costs

- Contract Fees: Typically higher than employee wages to account for self-employment taxes and lack of benefits.

- Liability Insurance: To protect against potential damages caused by the contractor.

- Administrative Costs: Contract management, payments, and compliance.

W-2 Costs

- Wages: The employee’s salary or hourly rate.

- Payroll Taxes: Social Security, Medicare, federal unemployment, and state taxes.

- Benefits: Health insurance, retirement plans, paid time off, etc.

- Administrative Costs: Payroll, benefits, and compliance management.

- Workers’ Compensation: Insurance protecting the business from legal action due to employee injury.

Pros and Cons

| Factor | 1099 Pros | 1099 Cons | W-2 Pros | W-2 Cons |

|---|---|---|---|---|

| Employer | Cost-effective, less paperwork, flexibility | Less control, liability, limited availability | Control, stability, tax benefits | Higher costs, paperwork, less flexibility |

| Employee | Flexibility, independence, tax benefits | No benefits, inconsistent pay, tax responsibility | Stability, benefits, predictable pay | Less control, limited tax benefits, employer-dependence |

California Example: Marketing Consultant

Worker Classification Cost Calculator

Compare the total costs between W-2 employee and 1099 contractor classifications

W-2 Employee Costs

- Base Salary

- $0

- Employer Taxes

- $0

- Required Benefits

- $0

- Common Benefits

- $0

- Administrative

- $0

- Total Cost

- $0

1099 Contractor Costs

- Contract Rate

- $0

- Administrative

- $0

- Total Cost

- $0

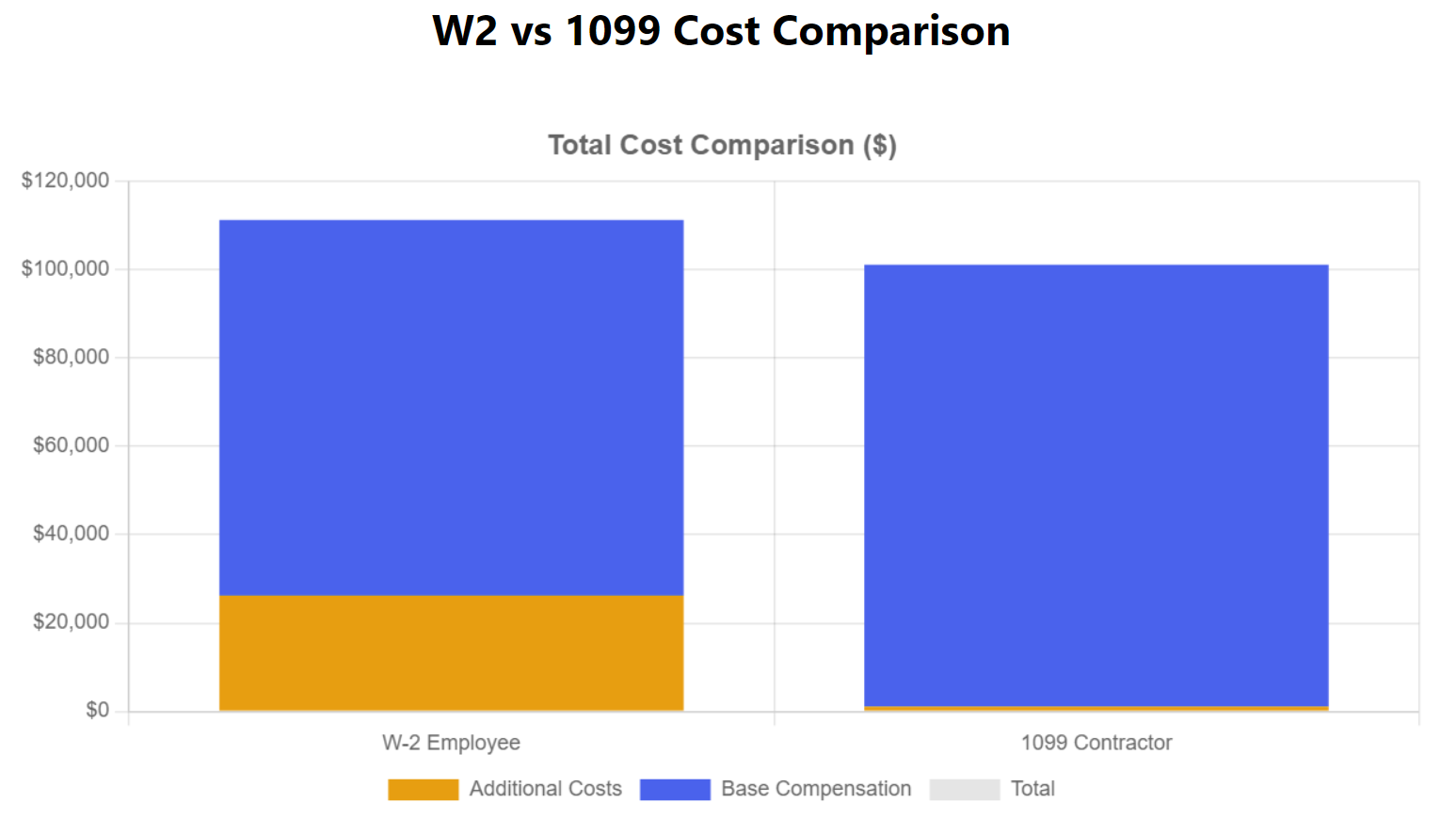

Let’s dive deeper into a real-world scenario to illustrate the cost differences between hiring a marketing consultant as a W-2 employee versus a 1099 contractor in California.

Scenario

- Base Compensation: $85,000 per year

- Location: California

- Position: Marketing Consultant

- Business: Small company with <50 employees

W-2 Employee Cost Breakdown

| Cost Category | Item | Amount |

|---|---|---|

| Base Salary | – | $85,000 |

| Employer Taxes/Insurance | Social Security (6.2%) | $5,270 |

| Medicare (1.45%) | $1,232.50 | |

| California State Unemployment Insurance (2.7%) | $189 | |

| Employment Training Tax (0.1%) | $7 | |

| Workers’ Compensation Insurance (approx. 0.5%) | $425 | |

| Required Benefits (California) | Paid Sick Leave (minimum 24 hours/year) | $980 |

| CA Family Rights Act compliance | $500 | |

| COVID-19 Supplemental Paid Sick Leave | $980 | |

| Common Benefits | Health Insurance (80% employer contribution) | $8,400 |

| 401(k) matching (3%) | $2,550 | |

| Paid Time Off (2 weeks) | $3,270 | |

| Administrative Costs | Payroll processing | $420 |

| HR administration | $1,200 | |

| Benefits administration | $800 | |

| Total W-2 Cost | – | $111,223.50 |

1099 Contractor Cost Breakdown

| Cost Category | Item | Amount |

|---|---|---|

| Contract Rate | – | $100,000 |

| Business Costs | Contract administration | $500 |

| Liability insurance | $400 | |

| Payment processing | $200 | |

| Total 1099 Cost | – | $101,100 |

California Considerations

California ABC Test Requirements

All three conditions must be met to classify a worker as an independent contractor

Autonomy

Worker is free from control and direction in performing work, both under contract and in fact

- Sets own hours

- Chooses work methods

- Works without supervision

Business Scope

Work performed is outside the usual course of the hiring entity’s business

- Different business type

- Distinct service offering

- Independent operation

Customary Trade

Worker is customarily engaged in an independently established trade, occupation, or business

- Has other clients

- Markets services

- Maintains business location

ABC Test

To qualify as an independent contractor in California, the consultant must:

- Be free from company control.

- Perform work outside the company’s usual business.

- Have an independently established business.

Misclassification Risks

- $5,000 – $25,000 per violation under Labor Code § 226.8.

- Back payments for overtime, benefits, and expenses.

- Penalties for wage statement violations.

- Potential criminal penalties for willful misclassification.

Key Insights

- Initial Cost: W-2 is 9.1% higher than 1099.

- Hidden Factors: Employee loyalty, contractor availability, and California’s strict laws.

- Risk: W-2 has lower legal risk, 1099 has lower base costs but higher legal risks in California.

- Long-Term: Training investments, contractor availability, and California’s aggressive enforcement.

Compliance Tips

- Document ABC Test compliance.

- Regularly review contractor relationships.

- Mitigate risk by using staffing agencies or consulting with employment counsel.

This example illustrates that while a 1099 contractor may appear cheaper, California’s strict laws make proper classification critical.

California ABC Test Requirements flowchart:

Risk Management

Properly classifying workers is crucial to avoid legal and financial risks. Here are some key risk management strategies:

Documentation

- Maintain thorough records, including:

- Written contracts for independent contractors, clearly defining the scope of work and independence.

- Expense reports and invoices for contractors.

- Time records for employees, including hours worked and breaks taken.

Regular Review

- Conduct regular reviews of worker classifications, especially if the nature of the work or the relationship changes. This includes:

- Annual review of independent contractor relationships to ensure they still meet the classification criteria.

- Documentation of the decision-making process for worker classification.

- Regular updates to contracts and agreements to reflect any changes in the relationship.

Common Pitfalls

- Be aware of common misclassification errors, such as:

- Treating independent contractors like employees by dictating their work hours or requiring them to use company equipment.

- Misclassifying employees as independent contractors to avoid paying payroll taxes and benefits.

- Failing to properly document the relationship and the reasons for classification.

By implementing these risk management strategies, you can minimize the likelihood of misclassification and protect your business from potential legal and financial consequences.

FAQs

Can I be both a 1099 and W-2 worker?

Yes, you can be both an independent contractor and an employee, even for the same company, as long as the nature of the work and the relationship meet the classification criteria for each.

What happens if I misclassify a worker?

Misclassification can result in significant penalties, including back taxes, unpaid benefits, wage violation penalties, and in some cases, criminal charges. The IRS may require you to pay both the employer and employee portions of unpaid payroll taxes, plus penalties and interest.

Can I classify remote workers as 1099 contractors?

Remote work alone doesn’t determine classification status. The same IRS and state tests apply regardless of work location. You must evaluate behavioral control, financial control, and the nature of the relationship.

What is the typical cost of workers’ compensation insurance?

It varies by state, industry, and job, but typically ranges from 0.1% to 5% of an employee’s wages.

Do I need liability insurance for 1099 contractors?

While not legally required, it’s recommended to maintain liability insurance that covers independent contractors. You should also require contractors to carry their own liability insurance and add your business as an additional insured.

What are some common employee benefits?

Common benefits include health insurance, retirement plans (such as 401(k)s), paid time off, disability insurance, and life insurance.

Can I offer benefits to 1099 contractors?

While you can offer certain benefits to contractors, doing so may strengthen an argument that they should be classified as employees. Any benefits offered should be carefully structured and documented.

How do state laws affect worker classification?

States may have different or stricter classification tests than federal law. For example, California uses the ABC test, while other states might use different criteria. Always check your state’s specific requirements.

What if my contractor works in a different state?

You’ll need to comply with both the contractor’s state laws and your state’s laws. This includes wage laws, unemployment insurance, and workers’ compensation requirements.

How long can I hire someone as a 1099 contractor?

There’s no specific time limit, but longer engagements may face more scrutiny. The key is maintaining a true independent contractor relationship throughout the engagement.

Can I convert a 1099 contractor to a W-2 employee?

Yes, you can convert a contractor to an employee. However, this may raise red flags about the previous classification. Consider consulting with a tax professional about any past liability.

Connect with XOA Tax

Need help with worker classification or understanding your obligations as an employer? Contact us!

Website: https://site2.xoatax.net/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://site2.xoatax.net/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.