The One-Person CFO Model is Obsolete

We give you better deal! All that at even lower price.

The Most Expensive Hire You'll Ever Make Isn't Who You Think.

You did what you were supposed to do. You hit a growth stage and hired a CFO. You checked the box. But the nagging feeling won't go away. Why are you still...

Making critical decisions on "gut feel"?

Your CFO gives you reports, but you lack the predictive insights to know if you can really afford those new hires or that marketing expansion.

Getting bottlenecked by one person's schedule?

When your CFO is swamped with board prep or fundraising, critical operational analysis grinds to a halt.

Paying for a single playbook?

Your CFO is sharp, but their experience is capped. They’ve seen their past deals, not the hundreds of scenarios needed to navigate your future.

Worrying about what happens if they leave?

Your entire financial strategy and institutional knowledge walks out the door with them, leaving you dangerously exposed.

New

Approach

Stop Hiring a Person. Install a Financial Engine.

At XOATAX, we’ve fundamentally redesigned the finance function. We replace the outdated model of a single, expensive CFO with a dynamic, tech-powered ecosystem.

You get a dedicated lead strategist backed by a remote team of specialists in financial modeling, tax strategy, M&A, and more—all coordinated through our AI-driven platform for unmatched efficiency and insight.

We will help you to ideate, design, and develop your finance

Collective Intelligence on Demand

Your lead CFO is backed by our entire network. Facing a complex revenue recognition issue? We bring in a specialist. Prepping for a Series B? Our fundraising veterans pressure-test your model. You get institutional-grade knowledge, not one person's opinion.

20+

Years of experience

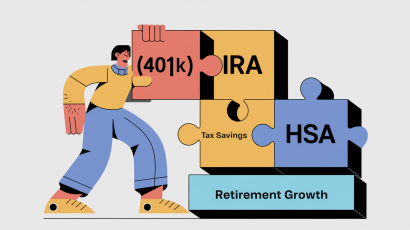

AI-Powered Predictive Insights

Our platform doesn't just report the past; it models the future. We leverage AI to run scenario plans, forecast cash runway with 99% accuracy, and identify cost-saving opportunities you didn't know you were wasting—turning your financials into a strategic weapon.

10+

Leading Experts

A Scalable, Unbreakable System

Our service scales with you. Need more support during a fundraise? We deploy more resources instantly. Quiet quarter? We scale back. There's no single point of failure, no knowledge lost to turnover. It's a resilient financial infrastructure built for growth.

100+

Clients Connected

The Old Way is Broken, Welcome to the New Standard.

Capability

Traditional CFO

XOA TAX CFO

Expertise

Capped by one person’s experience.

Collective intelligence of an entire network of specialists.

Speed & Bandwidth

A single bottleneck; sequential tasking.

Parallel processing by a dedicated team; never a bottleneck.

Technology

Dependent on their preferred tools.

Integrated AI platform for predictive modeling and real-time dashboards.

Cost Structure

High fixed salary + benefits + bonus ($300k+).

A single, scalable subscription at a fraction of the cost.

Risk

Single point of failure; knowledge walks if they leave.

Resilient system; institutional knowledge is retained.

Your Path to Financial Command in 3 Simple Steps

1. Deploy the Diagnostic

We connect to your systems and run a full "Financial Scalability Audit," identifying immediate risks, cash leaks, and strategic opportunities.

2. Integrate the Team

We assign your dedicated lead strategist and integrate our core team of modelers and analysts. Your custom KPI dashboard goes live within 14 days.

3. Operate with Confidence

Through a regular cadence of strategic meetings and real-time reporting, we become your proactive financial engine, guiding every critical decision.

Trusted by Founders Who Demand More

What I like most is how proactive they are. They don’t just file taxes, they advise me on cash flow, inventory costs, and even how to structure my business for growth. As an ecommerce auto parts seller, margins can be tight, and their guidance has directly improved my bottom line.

Luis V.

Johnny and Duy were incredibly helpful. They not only helped me with my tax return but also fixed some mistakes I’d made on my own previous returns.

I learned my lesson: leave tax returns to the professionals. These guys are true professionals and know what they’re doing, providing great service and peace of mind.

For three years, I’ve had a pleasant and professional tax filing experience. If you want quality, timeliness, and professionalism, you’ve come to the right place. I highly recommend them.

The team is very communicative and helpful. Sending documents is easy, and they answer all my questions quickly. The pricing is also fair, making the overall experience excellent.

Our small business had some challenging financial situations, and previous tax preparers only offered basic filing. XOA TAX, led by Kevin Zhang, immediately identified areas where we were overpaying and developed a strategic plan that significantly improved our corporate health.

Their ability to quickly dissect complex scenarios and deliver clear, actionable advice is unmatched. The efficient electronic communication also means we get rapid, accurate results without any hassle. They truly understand what it means to be a strategic partner, not just a service provider.

Eric S.Business Owner

Eric S.Business Owner Brian P.Irvine, CA

Brian P.Irvine, CA David KimE-commerce Business Owner

David KimE-commerce Business OwnerRequest Your Free Financial Scalability Audit

In a complimentary 30-minute diagnostic session, we will analyze your current financial operations and provide a clear, actionable report detailing your 3 biggest risks and opportunities for growth. No fluff, no sales pitch—just a strategic blueprint.

Even More Value for Your Investment

Ready to Upgrade Your Financial Engine?

The choice is simple – continue gambling on a single person or install a powerful, scalable system built to win. Get the collective intelligence, predictive insights, and strategic firepower your ambition deserves.