Navigating taxes can feel overwhelming, but understanding the standard deduction can simplify things a lot. Think of the standard deduction as a straightforward way to reduce your taxable income without the hassle of itemizing every expense. Let’s break it down together!

What is the Standard Deduction?

The standard deduction is a fixed dollar amount that lowers the income on which you’re taxed. It’s like a built-in discount from the IRS, helping you reduce your taxable income without listing out each deduction. Every year, the IRS adjusts this amount to keep up with inflation.

How Does the Standard Deduction Work?

When it’s time to file your taxes, you have two choices:

- Take the standard deduction

- Itemize your deductions

Choosing the standard deduction is simple. It’s a flat amount that makes filing your taxes quicker and easier since you don’t need to collect receipts or track every expense.

Standard Deduction Amounts for Tax Year 2024 (filed in 2025)

| Filing Status | Standard Deduction 2024 |

|---|---|

| Single or Married Filing Separately | $14,600 |

| Married Filing Jointly or Qualifying Widow(er) | $29,200 |

| Head of Household | $21,900 |

These amounts are adjusted annually for inflation.

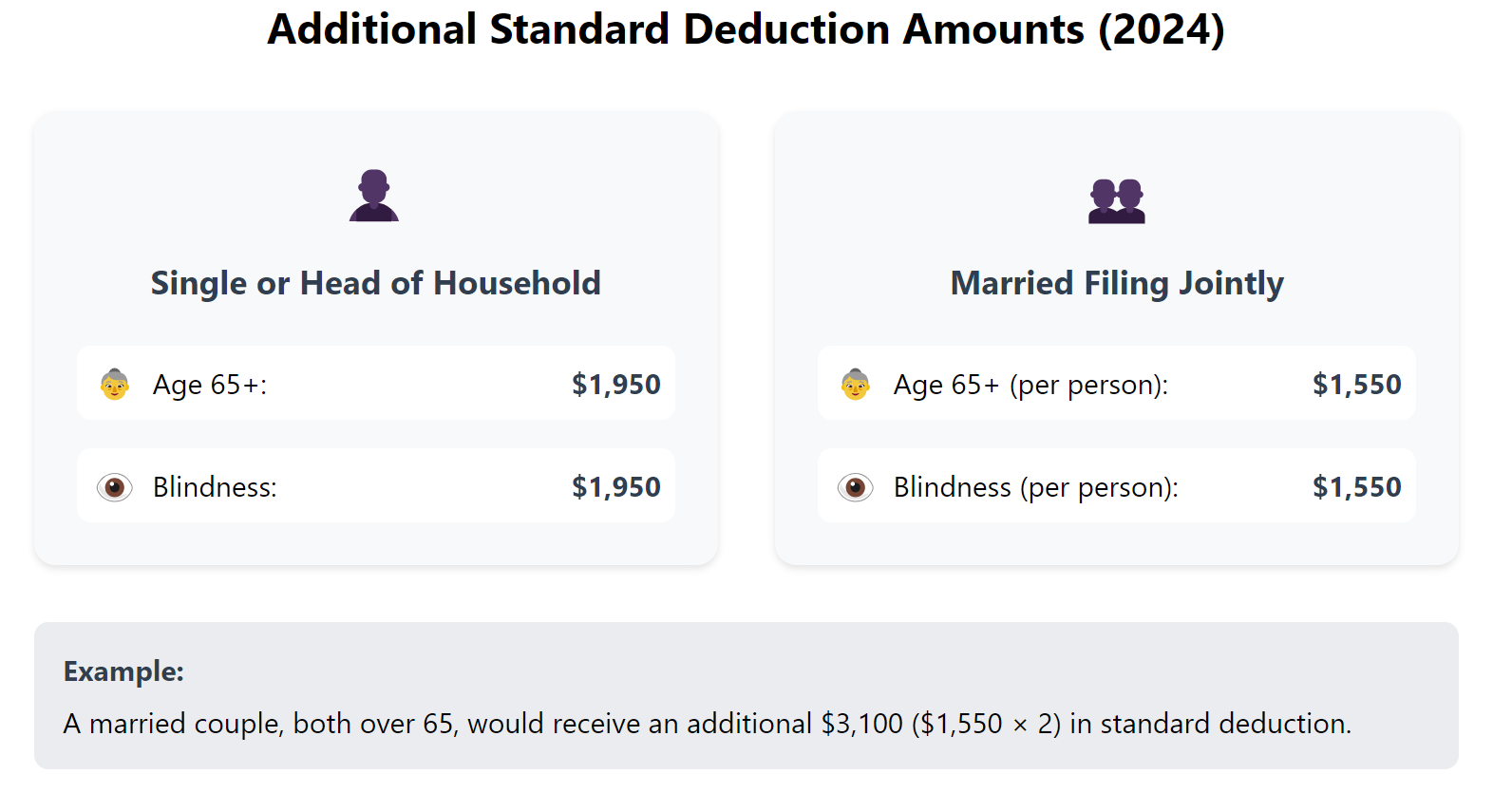

Extra Deductions for Age and Blindness

| Filing Status | Additional for Age 65+ | Additional for Blindness |

|---|---|---|

| Single or Head of Household | $1,950 | $1,950 |

| Married Filing Jointly or Surviving Spouse | $1,550 per person | $1,550 per person |

For example, a married couple filing jointly, both 65 or older, would get an extra $3,100 in 2024.

Standard Deduction for Dependents

If someone else claims you as a dependent, your standard deduction depends on how much you earned:

- 2024: It’s the greater of $1,300 or your earned income plus $450, but it can’t be more than the standard deduction for your filing status.

For instance, if you earned $1,000 in 2024, your standard deduction would be $1,450 ($1,000 + $450).

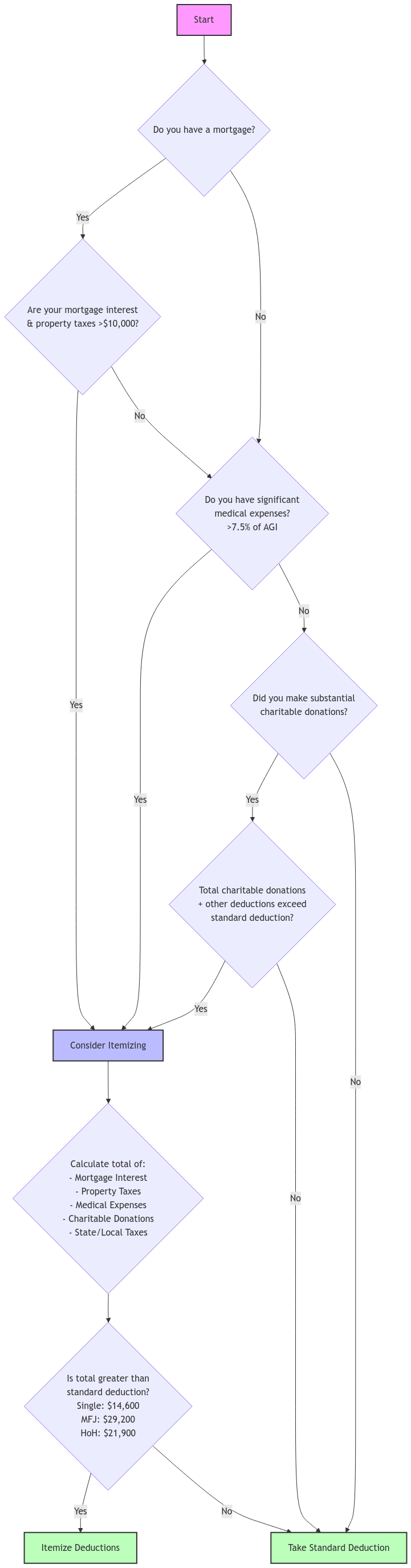

Should You Take the Standard Deduction or Itemize?

Deciding between the standard deduction and itemizing depends on which option saves you more money.

Taking the Standard Deduction

- Easy and Quick: It’s a straightforward reduction in your taxable income.

- Less Paperwork: No need to keep track of every expense.

- Good for Simplicity: Ideal if you don’t have many deductible expenses.

Itemizing Your Deductions

- List Specific Expenses: You can include things like mortgage interest, state and local taxes, charitable donations, and medical expenses that exceed a certain percentage of your income.

- Potential for Bigger Savings: If your total deductions are higher than the standard deduction, itemizing could save you more.

- Requires Records: You’ll need to keep detailed records of your expenses.

When to Consider Itemizing: If you have significant expenses, such as high medical bills or substantial mortgage interest, itemizing might save you more money.

Who Can Claim the Standard Deduction?

Standard Deduction Eligibility Checklist

Check all statements that apply to you:

Result:

Complete the checklist to see if you qualify.

Most U.S. taxpayers are eligible for the standard deduction, but there are a few exceptions:

- Married Filing Separately: If your spouse itemizes deductions, you can’t take the standard deduction.

- Nonresident Aliens: Generally not eligible, with some exceptions.

- Short Tax Years: If you’re filing for less than 12 months due to a change in your accounting period.

- Certain Entities: Estates, trusts, and partnerships can’t take the standard deduction.

Pros and Cons of Itemizing

Pros:

- Lower Taxable Income: Potentially reduces your tax bill more than the standard deduction.

Cons:

- More Work: Requires detailed record-keeping and documentation.

- Audit Risk: More documentation means more scrutiny if the IRS reviews your return.

When to Choose the Standard Deduction

- Compare Both Options: If the standard deduction is higher than what you’d get by itemizing, go with the standard deduction.

- Simpler Filing: It’s faster and requires less paperwork.

- Life Changes: Significant changes like buying a home or having large medical expenses can influence your choice.

- Use Tax Tools: Tax software can help you determine which option is better for your situation.

Frequently Asked Questions

What is the standard deduction for dependents?

For 2024, dependents can take the greater of $1,300 or their earned income plus $450, up to the standard deduction for their filing status. For more details, check out the IRS Standard Deduction Tool.

What are the standard deduction amounts for 2024?

– Single or Married Filing Separately: $14,600

– Married Filing Jointly or Qualifying Widow(er): $29,200

– Head of Household: $21,900

– Additional deductions are available for those 65 or older or blind.

What is the standard deduction for those 65 or older?

In 2024, if you’re 65 or older or blind, you can claim an extra $1,950 if you’re single or head of household, and $1,550 per person if you’re married filing jointly.

How is the standard deduction different from itemized deductions?

The standard deduction is a fixed amount you subtract from your income without needing to list expenses. Itemized deductions require you to list specific deductible expenses. Itemizing is beneficial if your total deductions are higher than the standard deduction.

What are the consequences of itemizing deductions instead of taking the standard deduction?

When you itemize, you forgo the standard deduction and must provide detailed records of your expenses. This can lead to greater tax savings if your itemized deductions exceed the standard deduction, but it requires more effort and documentation.

When should you claim the standard deduction?

Choose the standard deduction if it’s higher than your total itemized deductions. It’s simpler and faster, requiring less paperwork. Consider your financial situation and compare both methods to see which benefits you more.

Conlusion

Understanding the standard deduction can make tax season less stressful and help you maximize your tax benefits. Whether you choose the simplicity of the standard deduction or the potential savings of itemizing, being informed is the first step to a smooth tax filing experience.

Still have questions about the standard deduction or whether you should itemize? We’re here to help! Reach out to XOA TAX for personalized advice.

Website: https://site2.xoatax.net/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://site2.xoatax.net/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.