Choosing the right accounting software is crucial for any small business. In today’s fast-paced environment, cloud-based solutions offer unparalleled flexibility and efficiency. This review delves into QuickBooks Online (QBO), a leading cloud accounting software, exploring its 2024 pricing, key features, pros and cons, and top alternatives. As a full-service CPA firm, XOA TAX understands the importance of efficient financial management. We’re here to help you navigate the complexities of choosing the best software for your business. Contact us at +1 (714) 594-6986 or [email protected] for a free consultation.

What is QuickBooks Online?

QuickBooks Online (QBO) is a cloud-based accounting software developed by Intuit, designed to simplify financial management for small to medium-sized businesses. Accessible anytime, anywhere, QBO offers a range of features from basic invoicing and expense tracking to advanced inventory management and project costing. Its scalability makes it suitable for businesses at different growth stages, with regular updates ensuring you always have the latest features and security enhancements.

QuickBooks Online Pricing 2024

QBO offers several subscription plans, each tailored to different business needs. Promotional discounts are often available for new users. Check the official QuickBooks website for the most up-to-date pricing.

| Plan | Price/Month | Key Features |

|---|---|---|

| Simple Start | $30 | Income & expense tracking, invoicing, basic reports. Ideal for freelancers and sole proprietors. |

| Essentials | $60 | All Simple Start features + bill management, time tracking, up to 3 users. |

| Plus | $90 | All Essentials features + inventory tracking, project profitability, up to 5 users. |

| Advanced | $200 | All Plus features + advanced analytics, batch invoices, custom user permissions, up to 25 users. |

Key Features of QuickBooks Online

Accounting & Bookkeeping

- Income and Expense Tracking: Connect bank accounts for automatic imports.

- Invoicing and Payments: Create custom invoices, accept online payments, and automate recurring invoices.

- Reporting: Generate key financial reports (Profit & Loss, Balance Sheet, Cash Flow).

- Tax Preparation: Organize expenses for deductions and simplify tax time.

Automation & AI

- Smart Categorization: AI categorizes expenses based on past behavior.

- Automated Reminders: Automatic payment reminders to customers.

- Recurring Transactions: Automate recurring bills and invoices.

- AI Insights: Receive suggestions for cost savings.

Inventory Management

- Real-time Tracking: Monitor inventory levels, costs, and product availability.

- Automatic Updates: Inventory quantities are updated with every sale and purchase.

- Low Stock Alerts: Get notified when inventory is running low.

- Valuation Methods: Supports FIFO (First-In, First-Out) inventory valuation.

Project and Job Costing

- Profitability Tracking: Assign income and expenses to specific projects.

- Time Tracking: Log billable hours by project and employee.

- Budgeting: Set budgets for projects and compare actual costs.

- Detailed Reporting: Generate project-specific financial reports.

Mobile App Functionality

- On-the-Go Access: Manage finances from your smartphone or tablet.

- Receipt Capture: Snap photos of receipts and attach them to expenses.

- Mileage Tracking: Automatically track mileage using GPS.

- Notifications: Receive real-time updates on invoices and payments.

Third-Party Integrations

- E-commerce Platforms: Integrate with Shopify, Amazon, eBay, and more.

- Payment Processors: Connect with PayPal, Square, Stripe, etc.

- CRM Systems: Sync data with Salesforce, HubSpot, and other CRM tools.

- Over 650 Apps: Extend functionality with a wide range of applications in the QuickBooks App Store.

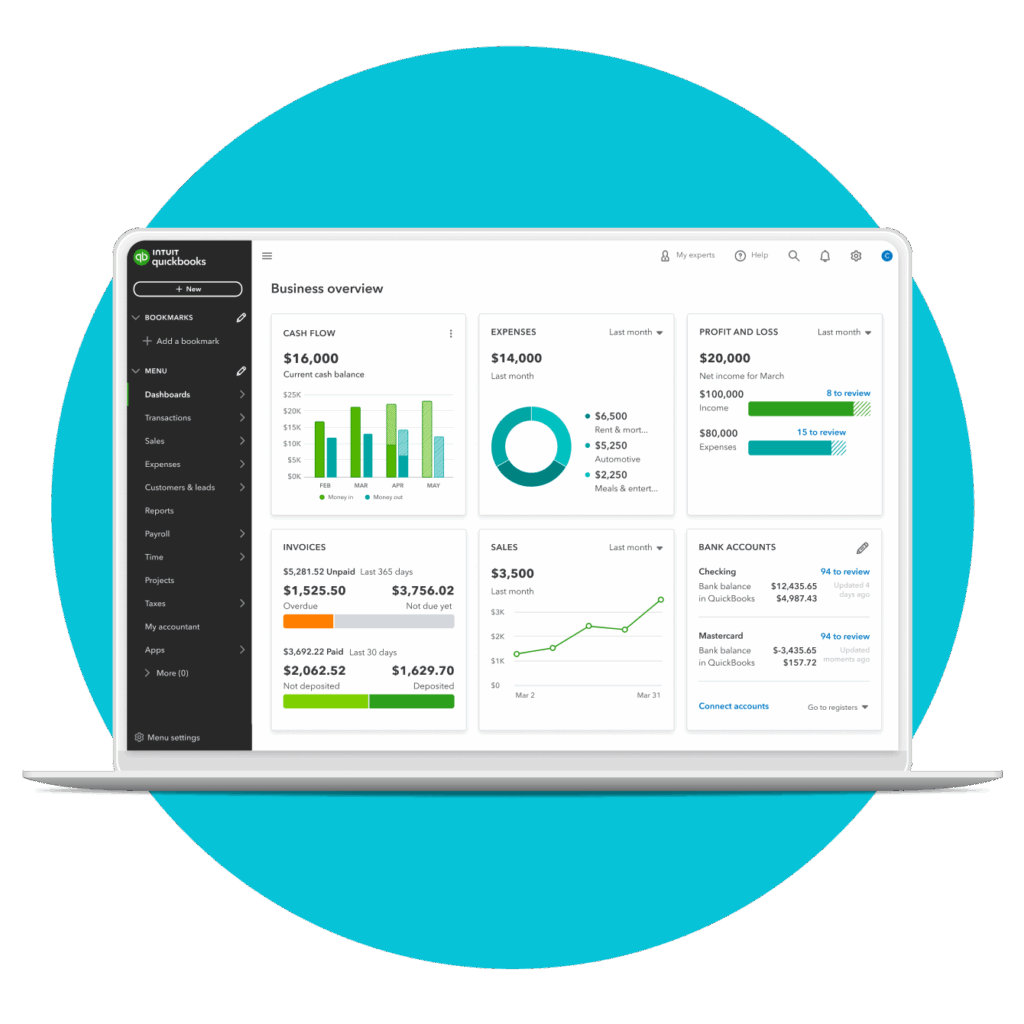

User Experience and Performance

QBO offers a clean, customizable dashboard and guided setup. However, advanced features can present a learning curve, and customization options for invoices and reports are somewhat limited. Performance is generally good, but occasional lag can occur. The software relies on a stable internet connection.

QuickBooks Online Pros and Cons

Pros:

- Comprehensive Feature Set: Suitable for various industries and business sizes.

- Scalable Plans: Easily upgrade as your business grows.

- Extensive Integrations: Connects with numerous third-party apps.

- Mobile Accessibility: Robust mobile app for managing finances on-the-go.

- Regular Updates: Continuous improvements and new feature rollouts.

Cons:

- Cost: Higher-tier plans can be expensive for small businesses.

- Support Limitations: Basic plans have limited customer support access.

- Complexity: Advanced features require accounting knowledge.

- Data Control: Reliance on cloud storage may raise data control concerns.

Customer Support & Security

QuickBooks Online offers several support channels, including live chat, phone support, a community forum, and a comprehensive knowledge base. However, response times can vary, and advanced support may require paid plans. QBO prioritizes security with 128-bit SSL encryption, two-factor authentication, and automatic backups. However, users rely on Intuit’s cloud security measures and internet connectivity.

Alternatives to QuickBooks Online

| Software | Overview | Strengths | Weaknesses |

|---|---|---|---|

| Xero | Cloud-based accounting software focusing on simplicity and collaboration. | Unlimited users, strong invoicing and bank reconciliation, integrates with 800+ apps. | Limited inventory management, learning curve for non-accountants. |

| FreshBooks | Designed for service-based businesses and freelancers. | User-friendly interface, strong invoicing, time tracking and project management. | Limited accounting features, extra fees for additional team members. |

| Wave | Free accounting software for small businesses and freelancers. | No subscription fees for core features, simple and easy to use. | Limited features, lacks advanced tools, email-based support. |

| QuickBooks Desktop | Locally installed QuickBooks version with robust features. | Faster performance, local data storage, one-time purchase option (though shifting to subscriptions). | Limited accessibility, remote access, and collaboration features. |

Conclusion: Is QBO Right for You?

QuickBooks Online remains a powerful accounting solution. Its features, scalability, and cloud accessibility make it attractive. However, consider your budget and specific needs. XOA TAX can help you make the right decision.

Need Help Choosing Accounting Software?

Contact XOA TAX today for a free consultation! We’ll help you assess your needs and recommend the best accounting software for your business. Call us at +1 (714) 594-6986 or email us at [email protected].

Disclaimer: Prices and features are subject to change. Consult the official QuickBooks website or a certified advisor for the latest information. This blog post is for informational purposes only and does not constitute financial advice.